The financial services industry, including credit unions, operates in a fast-paced, highly regulated environment where precision, efficiency, and customer satisfaction are paramount. Effective collaboration among teams isn’t just beneficial; it’s critical to staying competitive. However, outdated systems and fragmented workflows often hinder communication, innovation, and the ability to serve members effectively. By adopting modern collaboration platforms, financial institutions can overcome these challenges and enhance their operations.

Challenges of Collaboration in Financial Services

Financial institutions face unique obstacles that can complicate teamwork and efficiency:

- Siloed Departments: Teams handling loans, customer service, compliance, and marketing often work in isolation, leading to inefficiencies and missed opportunities.

- Data Sensitivity: Sharing information securely while maintaining compliance with regulations such as GDPR, CCPA, and PCI-DSS is a constant concern.

- Rapid Market Changes: Adapting quickly to changes in market conditions or regulations requires seamless communication and collaboration.

- Member Expectations: Today’s members expect fast, personalized services, which demand cross-departmental alignment and quick responses.

Benefits of a Unified Collaboration Platform

Implementing a modern collaboration platform can address these issues and deliver transformative advantages:

- Streamlined Operations: Centralized tools improve workflow efficiency, ensuring teams work together seamlessly to meet member needs.

- Improved Member Experience: Faster communication and better coordination translate into quicker responses and personalized service.

- Regulatory Compliance: Secure platforms ensure that sensitive data is protected and compliance requirements are met.

- Enhanced Innovation: Easy sharing of ideas and insights fosters creativity and helps develop new products and services.

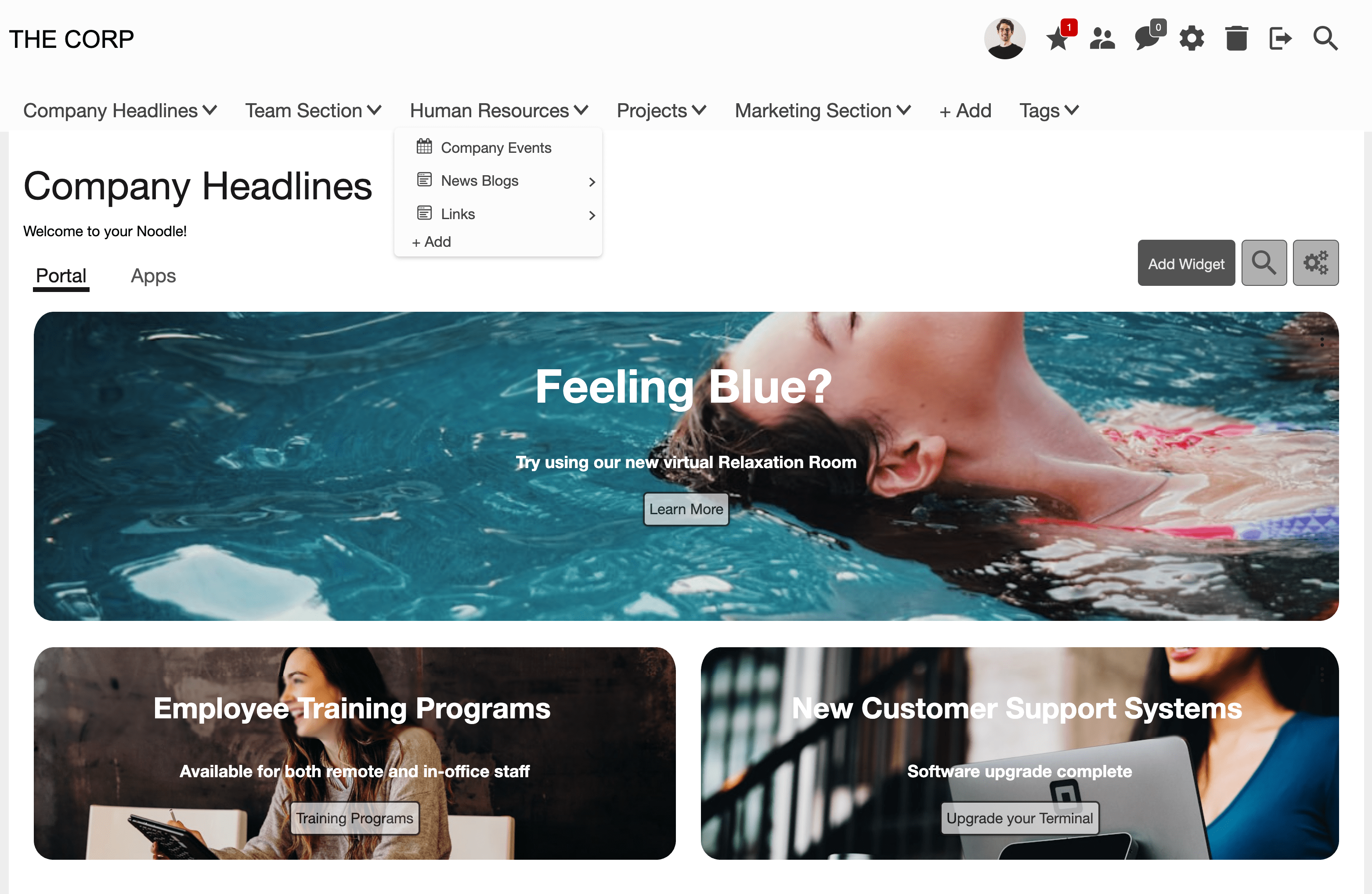

How Noodle Software Supports Financial Institutions

Noodle Software offers an all-in-one collaboration platform designed to meet the specific needs of credit unions and financial institutions. Here’s how it can help:

- Centralized Communication: Replace fragmented tools with a single platform where teams can collaborate in real-time through messaging, file sharing, and task management.

- Secure Data Sharing: Built-in encryption and compliance features ensure sensitive information is protected at all times.

- Customizable Workflows: Tailor workflows to streamline processes such as loan approvals, customer inquiries, and regulatory reporting.

- Integration-Friendly: Seamlessly connect with existing financial systems, from CRM platforms to document management solutions.

Real-World Impact

A leading credit union adopted Noodle Software to enhance internal collaboration and improve member services. By consolidating tools and improving team alignment, they achieved:

- A 20% reduction in response time to member inquiries.

- Increased efficiency in loan processing, cutting approval times by 15%.

- Improved compliance tracking, reducing audit preparation time by 25%.

Building the Future of Financial Collaboration

In a competitive and rapidly evolving industry, financial institutions must prioritize effective collaboration to deliver exceptional member experiences. Noodle Software provides the tools to simplify operations, ensure compliance, and foster innovation—positioning your organization for long-term success.

Ready to transform your credit union’s collaboration and member service? Discover how Noodle Software can help you achieve your goals today.